Emigrate to Portugal

The land of seafarers and great explorers is no longer just a tourist attraction but has also become an increasingly popular destination for emigrants in recent years. The Portuguese mainland offers fantastic beaches and coastal stretches, but also dense forests, national parks, picturesque cities, and gentle hilly landscapes. The Madeira archipelago, in the middle of the Atlantic, but also the Azores offer a mild and balanced climate all year round. If you are planning on moving to Portugal, you can find our guide with all the information regarding entry requirements and organizational details below. If you have any questions or comments about the content, we would be happy to assist you further. We have special article for UK citizens with extra information regarding the visa programs.

Sign up for our newsletter!

Entry requirements for Portugal

As a member of the Schengen Agreement, all citizens of the EU, Switzerland, and Liechtenstein can stay and work in Portugal without a visa. The documents required for entry are either a valid identity card or a passport. Other citizens need a visa.

How do I register in Portugal?

If you are staying in Portugal for more than three months, you must register with the municipal administration (Câmara Municipal) of your district. A registration confirmation (Certificado de Registo) will be issued here. The application costs a onetime fee of €15 and is valid for five years. You also need a valid ID document for registration as well as a proof of your residential address (e.g., through the rental agreement or a utility bill). You only have to prove sufficient assets if you do not have a permanent job yet. After five years, you can apply for a permanent residence permit (Certificado de Residência Permanente) at the immigration office (Serviço de Estrangeiros e Fronteiras). The Residência Permanente is perpetual, but the ID document must be renewed every ten years. Failure to comply with the registration obligation can result in fines between €400 and €1500, where incorrect information is provided, fines can be up to €2500.

Where do I apply for my tax and social security number?

You can apply for a tax number (also called Número Identificação Fiscal (NIF) or n° Contribuinte) at the responsible tax office (Servicos de Finanças). The respective citizens' offices (Loja da Cidadão) also issue this number. To apply, you need a valid ID document (should be valid for at least another year) and proof of your home address (e.g., through a rental agreement or a utility bill). Your NIF number will be issued directly after your application. To be covered by social security in Portugal, you must register with Seguranca Social. They will then receive the Número de Identificação de Segurança Social (NISS) - your social security number in Portugal. Benefits are only paid after you have paid social insurance for at least six months.

If you take up a job with an employer in Portugal, the notification is automatically sent to the employer. If you receive your pension from another country, you don't necessarily have to register with Seguranca Social. Only people who are available for the Portuguese job market have to register. The Seguranca Social is a system that covers all types of social benefits: health insurance, unemployment insurance, and pension insurance, as well as in the event of occupational disability. It also includes sickness benefits, maternity, and child benefits, and unemployment benefits. Seguranca Social also acts as a social and youth welfare office in Portugal.

How and where can I best open a bank account?

There are many ways to open a Portuguese bank account. You will find a large number of banks in all regions of Portugal. The best known are Caixa Geral de Dépositos, Banco Santander Totta S.A., Novo Banco, Banco Português de Investimento (BPI), Millennium and ActivoBank. A great advantage in Portugal is the Multibanco system, which provides machines that can be used to withdraw money, regardless of where you have your account. To open a bank account, you need a valid ID document, your tax number, and the registration certificate. Some banks make it particularly easy for you to check your payment transactions. ActivoBank has an app where customers can transfer money very easily, and that does not charge any account management fees. But not everyone is comfortable with the digital use for online banking. It is, therefore, advisable to have a look around for other offers and conditions.

Why should I get a Portuguese bank account?

Many employers only transfer salaries to Portuguese bank accounts, and fees for cash withdrawals and other transactions can be easily avoided. Internet providers usually want a direct debit authorization, but can only withdraw from national accounts. This also applies to most electricity providers in Portugal. If you make money in Portugal, regardless of whether you are self-employed or employed, you will have to pay tax sooner or later. Tax invoices are often issued on specific transfer forms and, foreign banks usually do not offer suitable templates.

How do I get a phone number in Portugal? Mobile or landline?

If you want a Portuguese phone number, whether landline or mobile, you can find various offers from national telephone and internet providers such as Vodafone, MEO, or NOS. All three companies have different offers for landline connections, which, depending on the package, also include TV and, Internet. Some packages also contain a mobile phone contract with a Portuguese mobile number. Services depend on the respective price, so it is also worth considering smaller providers, such as UZO. Since June 15, 2017, there are no roaming charges within the EU anymore. So if you want to make phone calls in Portugal with your mobile phone and your existing number, you can do this across providers at the conditions of your domestic tariff.

In addition to calls, this also applies to SMS, MMS, and mobile data volume. If you have messengers such as WhatsApp or Facebook installed on your cell phone, you can even make free calls worldwide with a working internet connection or sufficient data volume. If you are staying in Portugal for an extended period, it is advisable to get a Portuguese mobile phone number as soon as possible. If you do not want to be bound to a contract, there is also the option of a prepaid card. You can top these up with a certain amount of money and thus have full cost control. A Portuguese mobile phone number also makes it easier for you to conclude other contracts, such as electricity, landline, or even opening a bank account, since many online forms only allow local numbers.

The job market in Portugal

As of January 1st, 2020, employees receive a statutory minimum wage of €635 per month. The salary is paid fourteen times, resulting in a total of €8890 at the end of the year. The legal minimum wage in Portugal, like in other countries, is an essential reference for many provisions and regulations in labor and social law. Portugals wages are quite low compared to other European countries. Only Lithuania, Latvia, and Slovakia are behind Portugal with the euro currency countries. However, Portuguese salaries have risen slightly since 2015. When it comes to the actual wages, it should be borne in mind that it also depends heavily on the specific industry and that employees who speak several languages can earn more, especially when the companies have their headquarters in other European countries. You will find most companies in the two largest cities in Portugal: Lisbon and Porto. The food and textile industries are important branches, and the metal industry, cork processing, and the financial sector are also becoming significant employers in Portugal.

Another very important job market is the tourism industry, which has many employees, especially in summer and in the areas of the Algarve, the Azores, and around Lisbon. The labor market in Portugal for expats is primarily dependent on language skills. The official language, of course, is Portuguese and increases the chances of finding a job. For foreigners, without any knowledge of Portuguese, it is also possible to work for companies that have headquarters in their respective home countries and are also based in Portugal. Many Portuguese companies with trade relationships to e. g. Germany are also increasingly looking for German-speaking employees. Comparatively few people study in Portugal, but the need for well-trained specialists in the fields of business administration, engineering even so in the IT area is increasing. A good time to apply is from February to June, especially for students who have just graduated, because that's when most companies are hiring.

Do I need a work permit?

EU citizens do not need a work permit to work in Portugal. The only requirement here is that you have to register with the registration office if you are staying for an extended period (more than 90 days). If you are still looking for a job, you must prove that sufficient financial resources are available for the time of the job search. In the case of an existing or prospective employment relationship, the employment contract or a confirmation from the future employer must be presented.

What taxes do I pay in Portugal?

Taxation is also a complex issue in Portugal and cannot be dealt with in general. For residents from abroad, in particular, it is often advisable to consult a tax advisor to avoid any errors in the subsequent tax return. Every employee or self-employed person in Portugal is also obliged to submit a tax return. Sometimes the tax offices refrain from doing this but only in rare cases. This must be discussed with the responsible tax office in your place of residence. There are two different types of income tax: IRC (Imposto sobre o Rendimento de Pessoas Coletivas) corresponds to corporation tax. The IRC refers to companies and profits are taxed at a flat rate of 21% in mainland Portugal, 20% in Madeira and 16.8% in the Azores.

IRS (Imposto sobre o Rendimento de Pessoas Singulares) corresponds to wage and income tax. The IRS is issued by all other types of income, including the selfemployed. The total income is divided into five tax classes (escalões), and the tax class is based on the annual income. It also depends on whether you have children, are otherwise dependent, or if you are married. The relevant tables for the IRS can be found online:

http://info.portaldasfinancas.gov.pt

These tables and tax laws are updated annually in the Orçamento do Estado (OE) and announced in March of each year. It has been possible to enter your bills online for a few years already if a tax number has been provided. The system is called E-Fatura:

https://faturas.portaldasfinancas.gov.pt/home.action

It is particularly practical that all invoices are already in the system when the tax return is made and are transferred to the IRS.

All invoices that are issued by February 15 can then be moved to the correct section. As an additional help, the tax office provides an annual fill-in help that you can download from your Financas portal. The submission of the IRS runs from April 1 to May 31. Any tax refunds will be paid by August 31 of the same year at the latest.

What is the best way to get health insurance in Portugal? Social or private?

A statutory health insurance obligation also applies to Portugal. It ensures the basic medical care of the Portuguese population, and everyone living and working in the country. Unlike in other countries, there are no different providers for statutory health insurance, so you don't need to apply for anything. If you already have a permanent job, your employer usually registers you with the regional insurance carrier (CRSS - Centro Regional de Segurança Social) and also pays the contributions. However, in order to be able to go to the doctor, you must go and register with your responsible health center (Centro de Saúde). You can do this personally and only need your identity card and your registration confirmation.

The main advantage of statutory health insurance is that there are usually no additional costs for doctor's appointments. You only have to pay for the prescribed medications at the pharmacy. One of the disadvantages is the long waiting time for an appointment. Depending on the occupancy of the health center, you may have to wait several hours to make an appointment, which usually is for the next day. It is therefore often advisable to go in the morning. Since the benefits of statutory health insurance are not enough for many emigrants, it is advisable to take out private health insurance. Depending on the insurance and the respective offers can differ significantly from one another.

What should I look for in private health insurance?

To be able to use the full range of services, most insurers often have to pay for the first visit to the doctor. Only the next appointments are either partially or completely paid for by the insurance. Usually, dental bills are not included in most offers and often have to be booked as additional insurance. This applies, particularly to the cheaper tariffs. The full reimbursement of costs is only available from doctors and clinics in the respective insurance network. If you need to be treated but are currently in another city, it may be that only part of the treatment is covered. In particular cheaper insurance packages often offer a maximum amount for benefits per year. If you have insurance with a maximum limit of €15.000 per year, this can quickly be exceeded for specific illnesses or operations. You often have to get involved with extra services, such as blood tests or CTs.

What are the costs of private health insurance?

The costs differ depending on the services and age of entry and are between €15 and €150 per month. There are also insurance packages that can cost much more. It is generally advisable to take out private health insurance. With private insurance, you can go to private hospitals where you can also find many doctors who speak German, English, Spanish and French, which can avoid any language barriers at the beginning of your time in Portugal. What your health insurance should cover is a very individual decision, and it is, therefore, advisable to take some time to get precise information about prices and services and, if necessary, to compare several insurance companies with each other. There are also insurance offers from England or Denmark, which you should take into consideration. Here are some suggestions for private insurance providers:

- Advance Care

- MedicAll (from the alliance)

- Victoria Mundicare (from the Netherlands)

- Medis – Unimed

Important information on sick leave, sick pay and, loss of work

Under Portuguese law, lost working days of up to three days are not paid. So if you have a cold and are not going to work, this will be deducted from your salary at the end of the month. Employees can only apply for sick pay from the fourth day of sickness — selfemployed or people entitled to voluntary social insurance from the 11th day of incapacity to work. The amount of sickness benefit depends on the duration and type of illness. If the illness lasts from four to 30 days, you will receive 55% of your income. From 31 to 90 days, there is a rate of 60%, from 91 to 365 days 70%, and those who have been on sick leave for more than a full year receive 75% of their income. There are different rules when it comes to tuberculosis. It should be noted that only the public health authorities (Centro de Saúde) issue valid notes for sick leaves (Baixa). This is due to the fact that in the event of an incapacity to work, not your employer but the state will support you.

Pension scheme: Can I get a pension in Portugal?

If you have a regular job in Portugal or had one in the past, you are, of course, also entitled to a pension. There are two types of retirement. Firstly, the regular pension (Pensão de velhice) and the social pension (Pensão social de velhice). You are entitled to the regular one if you are an employee, are self-employed, or have voluntary social insurance. The right to a social pension applies to Portuguese nationals, foreign nationals residing in Portugal who belong to one of the member states of the EU, Iceland, Lichtenstein, Norway, or Switzerland (Community provisions on social security). You will receive your pension when you have reached the retirement age of 66 years and five months (as of 2019) at the time of application. If you have not yet achieved this, you can be entitled to an early retirement pension in the following situations:

• Involuntary long-term unemployment

• Certain health professions such as miners, seafarers, air traffic controllers etc.

• Long professional career liable to contributions

• As part of the system of flexibilisation of the retirement age

• Have a sufficient waiting period (at least 15 calendar years, which do not necessarily have to be consecutive and in which contributory earnings have been reported, or in the case of voluntarily insured persons 144 months in which contributory earnings have been reported).

The right to a social pension exists for persons who are not subject to a compulsory social security system or who do not fall within the scope of the transitional regulations for agricultural workers or persons who are covered by it but do not meet the defined waiting periods for retirement. In addition, recipients of a disability, old age or survivor's pension whose amount is below the minimum rate of the social pension. The amount of the pension is calculated on the basis of the contribution years and the insured person's reported earnings.

If there is a need for care, the regular pension may increase with the care allowance and also the solidarity allowance for older people, which is granted to pensioners residing in Portugal and with low income from the normal retirement age for pensions from the general social security system. It should also be noted that there are different retirement ages in all EU countries. If you are entitled to a pension in two or more EU countries, this will only be paid to you when you have reached the relevant retirement age. For example, this would be 60 years in France, but only 67 in Denmark. Accordingly, you would not be paid a Danish pension until you reach the age of 67.

Import procedures for vehicles: Can I bring my car to Portugal?

If you already have a car and don't want to sell it, you can take it to Portugal. You will need a Portuguese tax number (NIF) for the import and registration process. You must also be registered online with the Financas portal. The tax office will send your password to the address you provided within a few days. With this access data, you also have full access to the official vehicle tax simulator. What documents do I need to import a car?

• Original registration certificate (Part I and II)

• CoC document (Certificate of Conformity = homologação)

• Engine number: where is it stamped / readable? (not to be confused with chassis number!)

• Confirmation of the engine number from a Portuguese dealer

• Purchase contract of the car with registration, mileage, purchase price, chassis number

• Your Portuguese tax number

• ID document (ID card / passport)

• Driver's license

Photocopies of all documents should be made. Copies of the handed out and supplemented Portuguese documents should also be made for the subsequent authorities

How do I register my vehicle in Portugal?

When registering your vehicle for the first time in Portugal, you will need the form Impresso Modelo Unico (https://www.irn.mj.pt/IRN/sections/irn/a_registral/servicosexternosdocs/impressos/automovel/requerimento- deregisto / downloadFile / file / ANEXD57.pdf? nocache = 1216986303.52) as well as a certificate from the tax office that proves that the vehicle is "debt-free". If you only want to change the registration of your car inside Portugal, use the same form as for the first registration and submit your vehicle documents and your tax number. The registration is made by the Conservatória de Registo of the respective municipality.

When do I need to register my car in Portugal?

If you plan to move to Portugal, you also have to register your car. However, this does not have to be done right at the beginning. Portugal allows vacationers who are planning a more extended stay to drive a vehicle for 185 days per calendar year that is not registered in the country itself. If you stay less than six months, you do not have to pay a vehicle registration tax (Imposto sobre Veiculo). However, if the car is not registered, it cannot be rented in Portugal during this period. If you have been living in Portugal for more than six months, you are legally obliged to register your vehicle in Portugal. Then the ISV (registration tax) is due, and customs collect this. Not registering your vehicle can result in tax evasion.

Is my driving license valid, or do I need to change it as well?

Driving licenses from the EU are generally recognized in Portugal. This means that if you are only on holiday in Portugal, you do not have to be afraid of traffic controls. However, if you have already registered and are a resident with permanent residence, you must have your driver's license rewritten. In Portugal, there are national regulations that have to be applied to the license holder. As with the registration of a vehicle, there is no particular hurry to register a license. If you come from a country in which your driver's license is valid for an unlimited period or different than in Portugal, and you have been registered in Portugal for two years, you must exchange your driver's license. If you are over 40 years, you must provide a certificate of general fitness to drive. If you are also wearing glasses, a certificate from the ophthalmologist is required as well. If you only need a "normal" Portuguese driver's license (vehicles up to 3.8 tons and trailers up to 750kg, the above-mentioned certificates are sufficient. The medical documents must be sent online to the IMT (Road Traffic Office) since May 15, 2018. You can ask your doctor whether he has the appropriate software

What insurance is required in Portugal, and where do I get it?

In addition to the health insurance and pension insurance mentioned above, you also need car insurance for your vehicle in Portugal. It is also advisable to take out household insurance for your apartment or house. If you have registered your vehicle in Portugal, this must also be insured. In Portugal, vehicle taxes (IUC - Imposto Unico de Circulação) are payable after the year of the license plate. Payment can be made either directly through your Finanças account or in person at the tax office. The receipt for the payment must be carried in the vehicle.

Where can I find suitable insurance for my vehicle?

There are a lot of companies offering car insurance. It is advisable to inquire with your bank whether they can provide you with a suitable one as most Portuguese banks work with different insurance companies together. In Portugal, all vehicles must have at least liability insurance. Besides, the car is not insured, but the driver is. This means that different people can drive your car if they have a valid driver's license. The disadvantage of this type of insurance is that you cannot benefit from accident-free discounts as this is not taken into account in Portugal. The insurance premium depends on factors such as condition, age, brand, and model of the car. Two insurance modalities are available:

1. Liability insurance (Seguro de responsabilidade civil): This is required by law and covers damage to other people's property in the event of an accident.

2. Comprehensive insurance (Seguro de danos próprios): It also covers fire, theft, and bodily harm.

Of course, it is also advisable to get enough information and compare services and prices.

How important is a homeowner's insurance in Portugal?

Mainly, in a rental apartment, household insurance can protect against nasty surprises in the event of damage. If you need to replace furniture, for example, you can be reimbursed for this and other items. It is advisable to make a list and indicate the amount that you would have to spend in the event of significant damage. Some insurers do not pay compensation for damage to devices that are over eight years old. These include e.g., TV or DVD player. Computers cannot be older than five years. If possible, you should choose home insurance that will offer you full compensation regardless of the age of the damaged items. The value of your insured property is updated annually.

The Portuguese school system

Primary education in Portugal is called ensino básico and generally consists of three consecutive levels and begins after attending a preschool for children from 3 years. However, preschool is not a requirement in Portugal.

- Primeiro Cíclo (four years = 1st-4th class) with a single class teacher (professor / a de Turma), possibly supported by subject teachers, such as compulsory English lessons since 2015. This is general primary education

- Segundo Cíclo (two years = 5th-6th grade) and

- Terceiro Cíclo (three years = 7th-9th grade) with one teacher per subject or department, one of whom is also a Diretor de Turma (a kind of "class teacher" responsible for everything).

If students want to continue their school education and further qualify, they can attend secondary school. This comprises three school years (10th-12th grade). They can choose between the following three priorities: the scientific-humanistic branch, the artistically specialized branch, and the technological or professional branch. The corresponding lessons take place at secondary schools and vocational schools. This primary education is followed by vocational training or attending so-called additional courses - the cursos complementares. There are three courses of study here - either with specific preparation for the job or for studying at a university. However, a student in Portugal also gets a university entrance qualification if he attends the escola secundária for three years after high school and completes it.

In Portugal, there are now also three years of vocational training, which is mainly for students who have not yet completed their compulsory education and do not want to switch to the secondary level. The training is divided into theoretical and practical phases. After successful completion, the young people receive a double diploma for completed vocational training and for finishing secondary school.

Private or public school?

The public schools in Portugal are free for all children, but they do not cover financial support for the purchase of school books or other materials. For private schools, parents have to pay a certain amount each month. How much is set by the schools themselves, but it can be up to €800 a month or even more. Whether schools pay for teaching materials also varies from school to school. A distinction is made between private international schools and Portuguese private schools. The latter is particularly useful if you want your children to learn the new language as quickly as possible. The classes in private schools are smaller, which is why teachers may also be able to respond better to (new) international students. It depends on what is in the interest of your child and, of course, on the financial means. Following you will find a list of private schools in all regions of Portugal:

North of Portugal and Porto:

The Oporto British School Phone: (+351) 226 166 660 | www.obs.edu.pt

Escola Alemã do Porto Phone: (+351) 226 076 570

CLIP – Colégio Luso Internacional do Porto Phone: (+351) 226 199 160 | www.clip.pt

Colégio Luso-Francês Phone: (+351) 228 347 150 | www.lusofrances.com.pt

Lycee Francais International de Porto Phone: (+351) 226 153 030 / 31 | www.lyceefrancaisdeporto.pt

Escola do Turismo de Portugal // Porto Phone: (+351) 239 007 000 | escolas.turismodeportugal.pt/en/cursos

Lisbon:

The Cascais International School Phone: (+351) 214 846 260 | www.icsc.pt

St. George’s School Phone: (+351) 214 661 774

St. Julian’s School Phone: (+351) 214 585 300 | www.stjulians.com

Carlucci American International School of Lisbon Phone: (+351) 219 239 800 | www.caislisbon.org

Boa Ventura Montessori Phone: (+351) 214 688 023 | www.boaventuramontessori.com

International Preparatory School Phone: (+351) 214 570 149 | www.ipsschool.org

St. Dominic’s International School Phone: (+351) 214 440 434 | www.dominics-int.org

St. Peter’s School Phone: (+351) 212 336 990 | www.st-peters-school.com

Deutsche Schule Lissabon Phone: (+351) 217 510 260 | https://dslissabon.com/

Liceu Francês Phone: (+351) 213 871 218 | www.lfcl-lisbonne.eu

St. James Primary School Phone: (+351) 214 86 47 54 | jps.office@sapo.pt

PaRK International School Phone: (+351) 213 026 318 | www.park-is.com

Algarve:

Nobel International School Algarve Contact: (+351) 282 342 547 | nobelalgarve.com

Vilamoura International School Phone: (+351) 289 303 288 | www.civ.pt Penina

College Phone: (+351) 282 417 805 | www.colegiodapenina.com

Aljezur International School, Algarve Phone: (+351) 282 997 407 | www.aljezur-international.org

Vale Verde International School Phone: (+351) 282 697 205 | www.vvis.org

Colégio Santiago Internacional Phone: (+351) 281 328 677 | www.csi-tavira.com

Private schools and kindergartens are very popular amongst emigrants. International schools can be found all over the country and are extremely popular as well. Not only because of the foreign language use but also because of the smaller class sizes. Often, emigrants also choose private schools to give their children the opportunity to return to their home country after graduation so that they can easily search for a job or place to study there

Where can I find a suitable language school?

There are many ways to learn the Portuguese language. School or private language teachers, there are suitable teaching units for everyone. Language schools usually offer a wide range of different courses. Weekend courses, evening courses, online courses, or individual lessons. The advantage here is the relatively low price and the opportunity to get to know other expats. Intensive courses are usually also offered by language schools. These are particularly useful in the early days to gain basic knowledge as quickly as possible and to steadily consolidate communicational skills. However, if you already have a job and do not have time every day to devote yourself to language learning, an evening or weekend course might be more appropriate for you.

Private lessons or lessons in small groups are recommended if you want a teacher who can respond individually to you and your pace of learning and also actively support your learning progress. A language tandem is ideal if you already have some previous knowledge and would like to consolidate and improve it by speaking actively with locals. Another advantage here is, of course, meeting other language enthusiasts who may want to benefit from your mother tongue. Online courses can also help you learn the language. The clear advantage here is the free time allocation according to your needs.

Various apps for language learning have also become very popular, but are often more suitable for learning vocabulary than for strengthening communicational skills. What kind of model is the right one for you depends on your individual needs. Often it is also worthwhile to gain a little previous knowledge of vocabulary via apps or online courses and then continue with a language course.

Cost of living in Portugal

It is, of course, also important to know whether your money is enough in Portugal and what expenses you can expect. It isn't very easy to calculate a general average of the cost of living, as this depends not only on the different regions but also on the personal standard of life and the circumstances and requirements. The cost of living in Portugal has increased in recent years and has reached the general EU average in cities like Lisbon and Porto. This is especially true for rental apartments. In rural areas or outside the city centers, however, the costs are still quite low. The prices of many goods and services in Portugal are at a lower level compared to other European countries. However, imported products can be significantly more expensive.

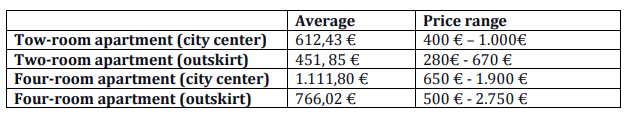

Monthly rental costs

Especially when it comes to rents, the city centers of Lisbon and Porto can be expensive. Many landlords increase rents in summer, as at this time, many tourists are looking for apartments that they can rent for several weeks. Therefore, it is advisable to search for flats either in autumn or even only in winter, since the rental prices then drop again in tourist strongholds and there is a lot more choice.

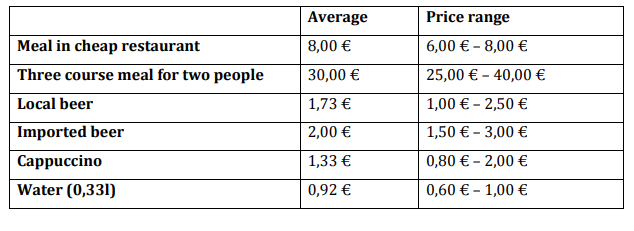

Gastronomy

In Portugal you can eat well and very cheap. Traditional Portuguese restaurants in particular often offer daily specials (Prato do dia) for €6 - €8. They are often also available as a complete menu with a salad, side dish and drink.

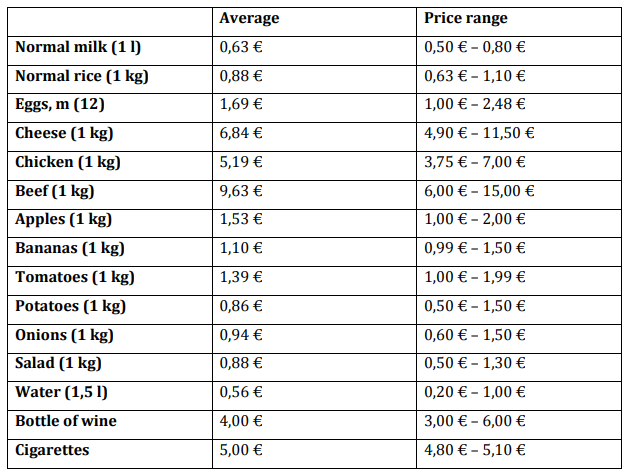

Food

You will also find discounters like Aldi and Lidl in Portugal. Although they offer a smaller selection of food than the large supermarkets, they are still unbeatable in terms of price. If you are looking for a larger variety of food, or a supermarket that also offers electrical goods, household items, cosmetics and clothing, Jumbo, Continente or Intermarché are recommended. An advantage with the large chains: They often have many offers with price reductions for food and cosmetic articles. If you have a customer card, you can benefit from further offers and discounts every month.

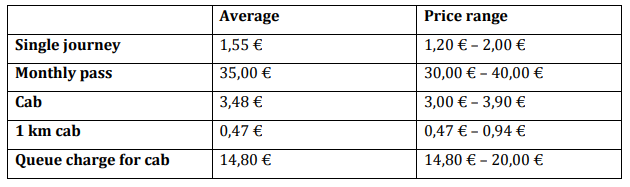

Public transportation

In and around larger cities, you often don't need a car. Lisbon and Porto, in particular, have great public transport connections. Even if you decide to live in the Lisbon area, for example (Cascais, Estoril, Carcavelos, etc.) or on the other side of the Tejo (Almada, Bairro, etc.) you have the option of using trains, buses or the ferry. Trains from Lisbon even run to Sintra every hour and enable you to commute easily. Fares by public transport in Portugal are comparatively cheap, and the option of a monthly pass makes it very easy for commuters. The price of the monthly ticket depends on the distance to the city center or your workplace. But it also includes all means of transport from the metro and bus to train and ferry.

Utilities per month

Incidental costs always depend on personal consumption but are also comparatively cheap in Portugal. The difference to other countries is that you do not pay a monthly flat rate for your electricity and water, but send your meter readings online to your provider every month. Every three months, someone comes to professionally read the meter readings so that everything is correct in the end. Therefore, you only pay for what you consume every month. Since many apartments and houses in Portugal have no heating, many use electric heaters. Some models are very energy efficient, but the electricity bill in many households is accordingly higher than in summer. You can expect additional costs (electricity, heating, air conditioning, water, garbage) of around 95,95 € for a rental apartment with two bedrooms

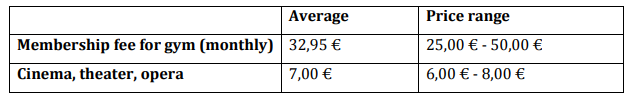

Sport and leisure time

If you want to register in a gym in your free time, there are countless options and offers. With annual contracts, you often pay less each month, but you are also bound for at least one year. However, many studios offer free trial lessons where you can find out if the course offer suits you. Other leisure activities such as Cinema, opera, or theater are relatively cheap, but they always depend on the production or length of the film.

Despite the great care, we take over no responsibility for the topicality, correctness, completeness.