Golden Visa Portugal - get independent advice to make the best investment

We summarise everything you need to know about the Golden Visa program in Portugal into the most comprehensive guide in the market. We also dedicated a whole section to the local real estate market in Portugal, investment funds or the best way to start a company in Portugal. If you have questions or remarks just let us know!

No pressure, Golden Visa is not ending!

If you are considering investing in Portugal for a Golden Visa you are probably under pressure to finish everything in 2021. But why if the program is not ending?

Every day we speak with clients looking for investments that will anyway qualify in the next year.

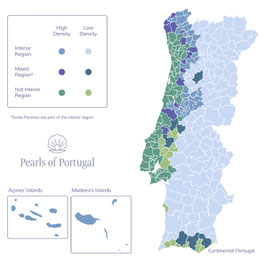

You can still invest 280k or 350k with renovation and 400k or 500k without renovation. The whole green area in the map on the left will still be available for investments in residential properties. In some parts of the interior, the property values grow by 16.5% a year and more than 7% in returns are expected.

In the white areas like Porto, Lisbon, and the Algarve you can still invest in non-residential properties like Airbnb apartments, hotels, vacation condos, office and much more.

Talk to us and ask for our investment guide. We are happy to advise you.

Contents

What are the benefits of the Golden Visa program in Portugal?

There are many benefits for the Golden Visa program in Portugal. The main benefits are listed below:

- You will be registered with the Schengen Area central system which will enable you to enter all European countries without the need for an additional visa (26 European countries) after your application has been approved by the SEF

- The program is not blacklisted by the Organisation for Economic Co-Operation and Development (OECD). Many European countries have Golden Visa programs and the Portuguese government recently reinforced the program

- After five years, you can apply for the Portuguese citizenship

- Family reunion is possible which means that certain dependent family members can also get Portuguese residency

- Access Portuguese healthcare and European education system if wanted

- You have the security of a second residence in a safe and stable country

- Having a second passport gives you always the possibility to leave your home country

- You do not have to actually live in Portugal to get the visa or citizenship

- You have the option to become a non-habitual resident of Portugal and pay little or no tax for 10 years

The Portuguese Non-Habitual Tax Regime grants qualifying individuals the possibility of becoming tax residents of a white-listed jurisdiction whilst legally minimizing income tax on certain categories of non-Portugal income for a period of 10 years. Golden Visa holders automatically qualify for the Portuguese Non-Habitual Tax Regime (NHR).

The Golden Visa in Portugal is extendable to family members like:

- Spouse or legal partner;

- Children under 18 years of age;

- Dependent children under 26 as long as they are unmarried and enrolled as full-time students; they also have access the the European education system

- Parents of either spouse if over the age of 66 years old (or 55 and dependent); and/or

- Siblings under the age of 18 years from either spouse or partner if legally responsible

Who can apply?

Any grown up who is not a citizen of the EU, EEA or Switzerland can apply for the Golden Visa. The applicants have to make an respective investment in Portugal and also have a clean criminal record. Currently the Golden Visa applications from Iran are suspended. The SEF does not accept the application for safety reasons which where not explained in more detail to the public. The Portuguese embassy in Pakistan is currently closed.

What are the requirements?

The requirements for the Golden Visa in Portugal are:

- An investment in Portugal

- Clean criminal record in Portugal

- No previous refusal of entry or visa to the EU

- Sufficient medical insurance if you decide to stay in Portugal

- Anyone who applies for the Golden Visa must spend a minimum of 7 days in the country in the first year, and 14 days in the subsequent years

- Golden Visa applicants must maintain their investment over a period of 5 years if they wish to apply for citizenship.

What are the options for the citizenship by investment?

The following options meet the criteria for the citizenship by investment in Portugal:

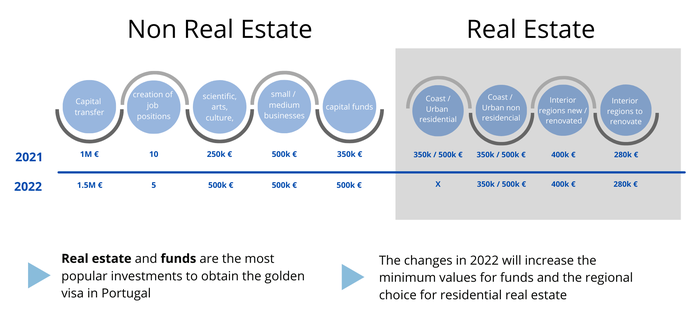

- Capital transfer of at least 1 million EUR into Portugal

- The creation of at least 10 job positions in Portugal by founding a company

- The purchase of real estate in Portugal worth at least EUR 500.000 EUR (reduced to 400.000 EUR if it is located in a low-density area). You can achieve this option also with more than one property which is from an investment point of view even better because rental returns do not grow proportionally with the real estate value

- The purchase of real estate in Portuguese urban regeneration areas or that is at least 30 years old to the value of at least 350.000 EUR (reduced to 280.000 EUR if located in a low-density area). In this option you have to invest some part of the money into renovations. Such projects need to be approved by SEF as qualifying for the reduced investment amount and it is critical to ensure the right project and legal advice is obtained before embarking on such investment

- Investment of at least 350.000 EUR in scientific research in Portugal

- Investment of at least 250.000 EUR in Portuguese arts, culture and heritage

- Investment of at least 500.000 EUR in small and medium businesses in Portugal

- Investment into private equity funds. A Golden Visa €350,000 minimum investment can be made to a private equity fund.

A low-density area which gives you a 20% reduced investment complies to the NUT3 level with fewer than 100 inhabitants per squared kilometer or GDP per capita less than 75% of the national average.

Note that you can not get a bank loan or mortgage in Portugal to buy a property. You have to prove that you bring the capital 100% to Portugal. Of course you can apply for a mortgage in your own country.

The transfers to purchase the property as well as to deposit money in Portugal have to come from accounts in your name. You can not transfer money or make purchases from other peoples or company accounts.

What are the new changes in the Golden Visa program?

No worries. By now nothing has changed. If you are in the middle of the process or have it started you will still have time. The new rules will not have any effect on the investments made in 2021. Our lawyers are already working to build a safe timeline of investment.

When will it have an effect?

The new rules will be valid for investments made from January 2022. Until there you can still consider all the options of investments.

What are the new options for citizenship by investment?

The following options meet the criteria for citizenship by investment in Portugal from January 2022:

- The purchase of a habitational real estate in Portugal of at least 280.000 EUR will be valid for the program if it is in the Autonomous Regions of the Azores and Madeira or in the interior territories. You can also verify the areas of low-density on our site.

- You can still invest in service (hotel, tourist renting) or industrial real estate in the cities or the coastal regions after 2021

What documents are needed?

Along with the Portuguese Golden Visa application, several documents are needed

to obtain the Golden Visa:

- Passport or valid travel ID

- Declaration of compliance with investment requirements

- Proof of legal entry into Portugal (eg. Schengen short-stay visa)

- Proof of health insurance (issued within the last three months)

- Criminal record certificate from country of origin/residence (issued within the last three months)

- Evidence of compliance with tax and Social Security obligations

- Receipt of payment of the Portuguese Golden Visa fees.

- A completed permission form which authorizes SEF to your Portuguese criminal records

- Bank declaration confirming the transfer of funds

The applicants need to show commitment to maintain their investment for a minimum of five years, plus evidence of their investment

The Portuguese Golden Visa application can be submitted online via the Portuguese Immigration and Borders Service’s (SEF) website. The application takes up to 6 months for approval.

You need the following certified documents from a Portuguese consulate or the embassy of your country translated into Portuguese

- Criminal certificate from country of origin

- marriage certificate

- Birth certificate of children

On top of those documents, you have to prove that you are committed to maintaining your investment for at least five years, as well as proof of your investment. Some examples of proof you can provide are:

- Deeds of purchase for all real estate investments

- Employment contracts for jobs that you created within the country

- A bank statement that displays your capital contributions

What are the costs?

First you have to realized the investment in Portugal. After the investment you can start to apply for the Golden Visa Portugal. The application is made by your lawyer and it takes up to 3-6 months for approval. If you also want to apply for your family members, it will be done at the same time. The first applicant pays 533 EUR processing fee, each additional family member pays 84 EUR.

The general costs for a family of four without the investments costs a simulated below:

Sign up for our newsletter!

What is the application process?

The application for the Golden Visa in Portugal follows a stricts process that has to be considered. Your lawyer will guide you through the enire process.

1. Decide how you want to make the investment - Before you apply for this visa, you need to have already made your investment. Investing in real estate can take anywhere between one to three months to finalize.Some options also include the renovation of a property. You do not need to wait until the renovations are finished as long as you can prove that you have already deposited the necessary funds in a Portuguese bank.

2. Start preparing and compiling your documents - You should start gathering documents for your application as it can take a few months to obtain them all. This can be done in parallel to finding the object in your investment category.

3. Get the Portuguese tax number and open a bank account in Portugal - You’ll need to get a Portuguese NIF and open a Portuguese bank account, as well.Both task can be done by you fast when you are in Portugal or remotely if you give somebody like Pearls of Portugal or a lawyer a power of attorney.

4. Finalize the investment - You have to decide on a concrete investment and transfer the funds needed to complete your investment to your Portuguese bank account. Please not that the money has to be transferred from an account in your name. Then you can do the investment. In the real estate option the final call should be done by the lawyer that is responsible for the application process.

5. Translate the necessary documents into Portuguese - The translation has to be certified by a Portuguese notary or a Portuguese consulate in the country of origin to meet SEF’s requirements.

6. File the initial application to the SEF - This steps should be done by a lawyer but you can also take this step by yourself. The Estrangeiros e Fronteiras (SEF) has an online portal where you can submit your application. You have to pre-register before you can apply.

7. Book your interview - Once you are pre-approved, you can then make your appointment. In bigger Portuguese cities like Lisbon and Faro, it can take up to three months to get an interview. If you schedule your interview in a less populated district, you might be able to reduce your waiting time.

8. Attend your appointment and a biometrics collection session - In your appointment, an immigration official will interview you, and they will collect your biometric data. If you are applying with your family, be sure to bring them along so that you can submit all of the applications simultaneously.

9. Wait for the final approval - Once your application has been approved, you will pay an authorization fee of 5324,60 EUR per applicant. After 10 days you will receive your residence card, which is valid for 1 year.

10. Use and renew the application - The residence card is renewable for two-year periods. In the second year you must submit your biometric data (fingerprints, etc.), present a current criminal record and pay a fee of 2662,30 EUR per applicant. In addition, the cost of the renewal process is 532.70 EUR for the main applicant and 83,10 EUR for each additional family member.

For the final application for the 4th and 5th year, you must submit your biometric data, present a current criminal record and pay a fee of 266,30 EUR per applicant. In addition, the cost of the renewal process is 532, 70 EUR for the main applicant and 83,10 EUR for each additional family member.

11. Become a Portuguese Citizen - After the last renewal process, you can renew your Golden Visa in Portugal or apply for a permanent residence permit, if you’ve maintained your investment and your minimum residency requirements.

What is a non-habitual resident in Portugal?

1 - What is the NHR regime?

The non-habitual tax resident (NHR) status is a tax regime created to improve Portuguese international competitiveness. This regime targets non-resident individuals who are likely to establish a permanent or a temporary residence in Portugal. Golden Visa holders automatically qualify for the Portuguese Non-Habitual Tax Regime (NHR).

2 - What are the benefits of the NHR regime?

The NHR regime establishes, under certain conditions, IRS exemptions on foreign source income, as well as a limited 20% taxation of income from employment and independent personal services, in both cases if deriving from listed of high value added activities.

3- How do you acquire tax residence in Portugal?

Staying for more than 183 days in the Portuguese territory, whether these days are consecutive or not, in any 12-month period beginning or ending in a given tax year;

If staying for a shorter period in the Portuguese territory, on any day of the period referred above, a dwelling under circumstances that lead to the presumption of an intention to hold and occupy it as a place of habitual abode;

4- What is the procedure to register as tax resident in Portugal?

Registering as a tax resident in Portugal is a requirement to obtain the non-habitual resident status, which means that those wishing to apply for the regime generally must:

- register as non-resident taxpayers;

- obtain residence permits (for non-EU nationals) and residence certificates (for EU nationals);

- register as tax residents; and

- only then you can apply for the non-habitual resident status.

5 - For how long may you enjoy the NHR status?

Non-habitual resident individuals may enjoy the status for a ten-year period. After this period they will be taxed under the normal IRS tax regime.

6- Once you have the NHR status, what are the tax requirements?

After obtaining the non-habitual resident status it will be necessary to file annual tax returns in Portugal, stating your worldwide income and expenses.

7- For how long are the benefits of the regime granted?

The NHR status is granted for a ten-year period.

8 - What types of income are eligible for exemption under NHR regime?

Foreign-sourced passive income (interests, dividends, certain royalties, other income from capital, capital gains and income from immovable real estate) derived by NHR is exempt (without progression except in the case of capital gains on real estate) in Portugal, provided that it is potentially liable to taxation in the source State (i) under the rules of an existing Double Tax Treaty (DTT) or (ii) in the absence thereof, under the rules of the OECD Model Tax Convention if such income is not deemed to arise from a State, region or territory included in the Portuguese tax havens’ blacklist nor from a Portuguese source under the IRS Code territoriality rules.

Foreign-sourced income from pensions falls under the IRS exempt (with progression) if not deemed to arise from a Portuguese source under the IRS Code territoriality rules.

Foreign-sourced employment income is IRS exempt (with progression), provided that it is effectively taxed in the source State (i) under the rules of a DTT or in, the absence thereof, (ii) of the OECD Model Tax Convention, as long as such income is not deemed to arise from a Portuguese source under the IRS Code territoriality rules.

Foreign-sourced employment income is IRS exempt (without progression) in Portugal, provided that it is income derived from high value added activities of a scientific, artistic or technical nature and it is effectively taxed in the source State (i) under the rules of a DTT or in, the absence thereof, (ii) of the OECD Model Tax Convention, as long as such income is not deemed to arise from a Portuguese source under the IRS Code territoriality rules.

Foreign-sourced income from independent personal services is IRS exempt (without progression) in Portugal, provided that it derives from high value added activities of a scientific, artistic or technical nature, as defined by Ministerial Order, and is potentially liable to taxation in the source State (i) under the rules of an existing DTT or (ii) in the absence thereof, under the rules of the OECD Model Tax Convention, if such income is not deemed to arise from a State, region or territory included in the Portuguese tax havens’ blacklist nor from a Portuguese source under the IRS Code territoriality rules.

9 - What types of income are eligible for reduced rates under NHR regime?

Income deriving from employment or independent personal services of a domestic or foreign source but not qualifying for the mentioned exemptions will be liable to autonomous taxation at a special 20% flat rate and not to the general and progressive IRS rates (currently of up to 53% for yearly taxable income above € 250.000), provided that it derives from high value added activities of a scientific, artistic or technical nature.

- Dividends

- Interest

- Real estate income

- Capital gains from the disposal of real estate

- Occupational pensions

- Royalties

- Business and self-employment profits derived from eligible occupations (but be mindful of relevant double taxation agreements in this respect)

What happens after the actual investment?

Now it is time to put all your documents together and enjoy Portugal while the Foreigner and Border Service (SEF) analyze it. Yes! If you want, you can from the time of the application live, study, or work in Portugal.

Is important to pay attention to:

Tip 1: Check your NIF regimentation: Why? You have to check this because the visa applicant becomes a tax resident in Portugal. For that reason, the foreign applicants for the Golden Visa who go for the interview step become bound to the tax regime, even those who do not intend to live in Portugal. However, there is good news, with this visa you are categorized as a non-habitual resident, which guarantees you do not have to pay most kind of taxes here.

Consult your Golden Visa Lawyer and make sure that you are categorized as a resident in Portuguese territory. If you are still registered as a non-resident, you must request a change of address and status for resident, with any Finance Service or Citizen's Shop.

Tip 2: It is important to make sure that you have all the needed documents for applying for a Golden Visa before starting the application process. Below you can check the list of the papers that are usually requested for you and your family members. We recommend that the documents are translated into the Portuguese Language.

Individual documents:

- Passport. This will still be your international identity before you receive your Golden Visa. Always keep this updated and take care of the expire date. Do not submit if it is close to expiring (six months)

- Proof of legal entry into in the country, the immigration stamp or notification at SEF

- International health insurance. It has to cover the period that you will be here, even if it is for the minimum stay period

- Country's criminal record certificate. Attention: this document must have been issued up to three months before the presentation of all the legally required documentation and translated into the Portuguese language

- Declaration on commitment and honor, being responsible for fulfilling all financial and time obligations of at least five years of the investment

- A certificate made by the Tax Authority and Social Security of Portugal saying that you do not have any debt with them, or, a declaration of the non-existence of registration with these entities

- Receipt of payment of the Gold Visa application analysis fee.

Attention - About the proof of investment: All the investment models listed above to obtain a Gold Visa have a discount for application in low-density areas, which reduces the investment value by 20 percent.

Purchase of 500.000 EUR property in Portugal

- Receipt of purchase of the property or promissory purchase and sale agreement;

- Receipt of transfer from your home country bank account to your Portuguese bank account;

- The deed or also known as property registration in your name;

- Updated register book of the property, whenever legally possible.

Purchase of an old property in urban regeneration areas (ARU) or in a low-density area

Important: The construction of the property must have been completed at least 30 years ago, or the property must be located in an Urban Rehabilitation Area - ARU so it may be less than 30 years old. In addition to the individual documents mentioned above, you must provide the following documents:

- Proof of request for authorization of rehabilitation works; or

- A reform company contract for the rehabilitation of the acquired property, as well as the payment vouchers that prove the minimum investment required

Funds Investment of capital at least 350.000 EUR

- Receipt of transfer from your home country bank account to your Portuguese bank account

- Certificate proving ownership of the fund units

- Declaration issued by the management company of the respective investment fund, attesting the viability of the respective capitalization plan

After gathering all the personal and investment documents, it's time to apply. The Foreigners and Borders Service (SEF) provides a website for it. There you can also indicate the e-mail address of your golden visa lawyer there. See below the step by step after receiving the login and password:

- Log in to the ARI Portal;

- Upload the documents required for the application according to the type of investment mentioned above;

- Confirmation of application. SEF recommends that documents should be placed in a single PDF format with a maximum of 4MB;

- Proceed to the "Payments" page to print the Single Collection Document (in Portuguese DUC) with the respective analysis rate, in this area you will also indicate the NIF;

- Proceed with the payment of the DUC. This document must be with you on the interview later, take a copy of the payment receipt.

The documentation analysis takes an average of three (3) to six (6) months, for this reason we recommend that the family reunification process be carried out together with the of the investor, this option it is valid for family members whose process analysis fee has already been paid. Check below the step by step indicated by SEF in the case of family reunification:

- Log in to the ARI Portal;

- Create the family group;

- For each member of the family group indicate as follows: Identification, degree of relationship and passport

- Confirm the Request for Family Reunification;

- Proceed to the "Payments" page to issue the Single Collection Document (DUC) with the respective analysis rate, in this area you will also indicate the NIF.

During this estimated time of document analysis, it is important to wait for the SEF contact to inform you if your application has been accepted and if you can proceed with the interview scheduling. If the application contains irregularities, SEF itself will indicate, in which case it will be necessary to make the correction and apply for the gold visa. Only after this documentary approval is it possible to schedule your interview at SEF. Once approved, you can now make an appointment. To do so, log in to the ARI (Golden Visa) portal and on the Application page, proceed to the “Calendar” option, select the most convenient day and time.

Tip 3: Because it is a long process, we recommend that for the interview you have a copy of all documents that have been digitally attached to the ARI portal (golden visa) updated, even if there has been no change, the SEF’s inspector may require that the documents are valid.

THE INTERVIEW: At this stage, your biometric data will be collected. This occurs since 2006 have become mandatory for visas. At the service station, photos of each visa applicant will be taken and the 10 fingerprints collected. If biometric data have already been collected, in the context of a previous visa application, less than four and a half years ago, the data may be copied. Children under the age of 12 and people unable to provide fingerprints do not need do this collection.

Pearls of Portugal recommends that the entire process should be done by a Golden Visa lawyer. The lawyer will be able categorize correctly and attach the documents more assurance, aiming at more efficiency and less waiting time.

Why move to Portugal?

In this time of uncertainty due to COVID-19, many questions arise regarding the future and better conditions for living, health, safety, jobs, and education systems. The search for a better quality of life and access to an efficient health system is one of the main reasons to apply for the golden visa and move even to Portugal.

Who can use the public and private services in Portugal?

- Foreign Citizens with dual Portuguese citizenship, who have a Tax Identification Number (NIF)

- Foreigners and their relatives with a residence visa, such as the Golden Visa (ARI)

- Foreigners from the Member States of the European Union, EEA or Switzerland;

- Foreigners with bilateral agreements with Portugal such as Andorra, Angola, Brasil, Cape Verde, Guinea-Bissau, São Tomé and Príncipe, Morocco, Mozambique, Quebec, and Tunisia.

Health system in Portugal

Do you know how the Portuguese health system works? Below we will talk a little about the Portuguese public and private health system and because it has become a reference in the world especially during the COVID-19 crisis.

Public health

The National Health System - SNS was created 41 years ago, a government agency that seeks to guarantee the right and protection of health. It consists of all services and public entities providing care, such as hospital establishments, health centers, and local units focused on primary health care.

To have the right to this public health system, it is necessary to be registered in the National Registry of Users - RNU at the health unit closest to your place of residence. With this number, you will be referred to the general practitioner, your family doctor who will be responsible for monitoring your health.

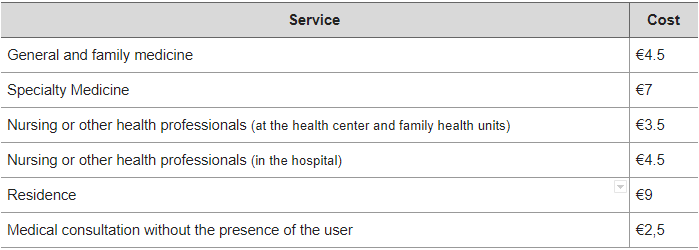

The Portuguese Public Health Service is not free. For each consultation or procedure, an amount called a "moderating" fee is charged. If there is a need to consult a specialist, your family doctor will provide you with a referral, which can be used to perform the consultation or examination in the public or private system. Below the values practiced from 2006 to 2019:

As of the beginning of this year, 2020, fees in the health centers and all acts prescribed by family doctors and professionals of the national health service are no longer charged. In pharmacies there is a big discount on the medicines indicated by the family doctor, these health expenses are deductible from the annual income tax return.

Private Health

The network of hospitals and private health centers in Portugal is also extensive and has well-equipped hospitals, to purchase an extra private health insurance or request unique consultations.

The amounts vary widely depending on the coverage, companies and the age of the insured, varying from ten to seventy euros per month. These categories of health insurance are reimbursed, that is, in addition to the amount paid monthly, it will be necessary to pay a usage fee or a moderating fee at the time of the procedure, for example, a consultation ranging from fifteen to fifty euros depending on the doctor's specialty.

In Portugal, there is also a grace period that varies according to the contract established between you and the insurance, on average ranging from 60 days to one year. Anyone who legally resides in the country can purchase health insurance, just have the tax identification number and look for the insurance that best suits your needs. Below the average values practiced for some services by the private network, which may vary:

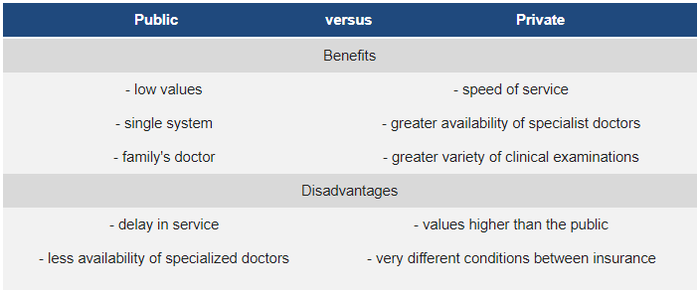

Public versus Private what is the best option?

Regarding the quality of care, it is very similar, because most health professionals work in both the public and private sectors. The main difference is the speed of scheduling appointments and carrying out procedures. While in the public sector to carry out a blood test it takes - depending on the urgency - an average of one month. In the private network it is possible to schedule appointments and tests for the same day. Another advantage is the value of specific tests, for example, a blood test that costs around 30 euros, when purchasing health insurance can cost up to 5 euros.

Education in Portugal

Portugal currently has a literacy rate of 95 percent. Focused on good structuring, teaching in foreign languages, and sport, the child who spends his entire school term in Portugal can count on quality and complete education. Divided into three stages, the child is 12 years old in his literacy process from kindergarten through basic education and secondary school.

- kindergarten: it is aimed at children from 3 to 6 years old, however, it has few places for having few schools directed to this phase of life;

- basic education: starts at 6 years old, is taken from the first to the ninth year, thus having the duration and 9 years.

- secondary education: already a teenager, at the age of 15, he starts the tenth year going up to the twelfth, closing the cycle of initial studies ending with 18 years.

The academic year here is different from some countries, it starts in September and ends around January of the following year. After a brief pause, classes are resumed from February until June.

The most up-to-date data we have are from the last ranking made in 2018 by the Directorate-General for Education and Science Statistics (DGEEC), which showed the best private schools in descending order:

Private schools in Portugal have a relatively high cost compared to the costs of public schools, which, like the health system, are not free. These costs vary according to the monthly income of parents or guardians, the lower the income, the lower the cost, and vice versa. To register your child in a public school, you should look for a parish council, the body responsible for the school administration. When arriving in Portugal, parents should look for the Parish Council closest to their residence and find out about which school can receive their child. In the case of private schools, just go to the school with the requested documentation.

The Universities of Portugal are considered good in the world ranking. Among the best are the University of Lisbon, University of Nova de Lisboa, university of Coimbra, University of Aveiro and University of Minho.

Security in Portugal

In the second half of 2019, Portugal moved from fourth to third place in the Global Peace Index. This ranking is produced by the Institute of Economics and Peace, which analyzes and classifies 163 countries (99.7% of the world population) according to 23 qualitative and quantitative peace indicators including indicators in the aspects of public security, management of external and internal conflicts in addition to combating terrorism.

So Portugal has become one of the top three most peaceful and safe cities in the world to live in. Standing out even from the neighbors, Spain and France, and being below only Iceland.

Besides, as it is a country of not very extensive dimensions and has broad support and social services, there is a great decrease in crime rates compared to neighboring countries, also contributing to an effective response by the police and intelligence services.

Despite the great care, we take over no responsibility for the topicality, correctness, completeness of the information on this site.